Contents

- 1 Introduction

- 2 Inflation is evading the entire supply chain and shrinking margins

- 3 Global optical companies are increasing prices to offset inflationary pressures

- 4 Focus on implementing new strategies

- 5 Mitigating supply chain risk

- 6 Launching new business transformation programs

- 7 Paying strong attention to global developments and changing policies

- 8 Conclusion

Introduction

Global manufacturers and inflation have a complicated relationship. Price increases for raw materials, labour shortages, and logistical problems are where it all begins. The combined impact of these issues could reduce manufacturing margins. This will ultimately pave the way for escalated product prices and service fees because of increasing pass-through expenses for global manufacturers, particularly global optical enterprises. However, it’s not as easy as it seems. Let’s have a look at how major optical companies manage inflationary pressures and come up with innovative strategies to lessen the impact of price increases.

Inflation is evading the entire supply chain and shrinking margins

The Consumer Price Index (CPI) climbed by an annualized 7.5% in January 2022, making it the highest in four decades. Meanwhile, many input costs for global manufacturers have been rising by a very wide margin. For instance, crude and aluminium prices hit an all-time high in the past three years. These data points clearly highlight that input cost pressures are not expected to ease soon. As this trend prevails among all the manufacturing industries, the optical fibre cable industry is no different.

Helium

supply, which is used as an

inert gas for cooling during fibre drawing, has become a sore point

for producers around the world. CRU suggests helium gas prices have

surged by at least 50%

in recent quarters due to production problems at the major US and

Russian suppliers.

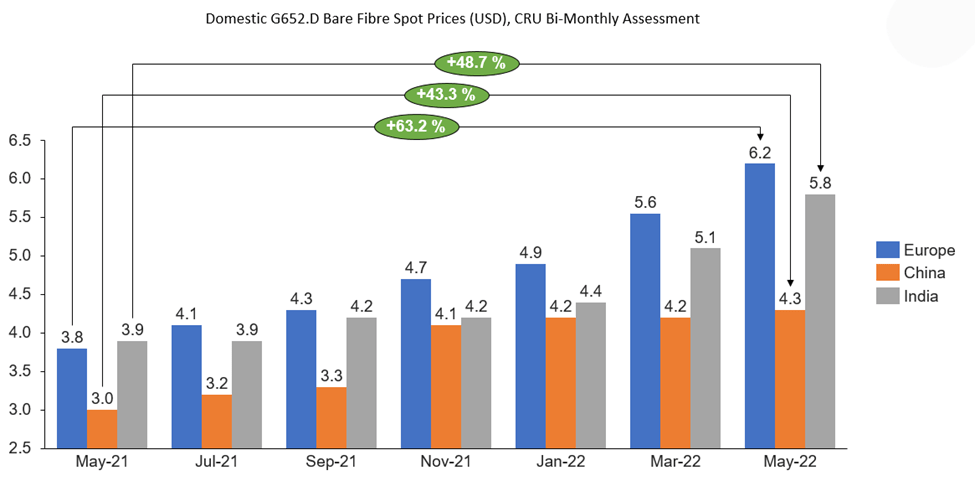

Raw material price hikes, and tight supply for helium gas, SiCl4, and HDPE, have once again pushed up fibre and cable prices. G652.D bare fibre spot prices increased, notably in Europe and India.

Along with raw material price hikes, supply chain disruptions are likewise expected to persist. According to the PWC pulse Survey 2022, supply chain challenges (in both availability of supplies and clogged logistics) are perceived to become a strong determinant of future growth. Most (58%) agree that improving supply chain resilience and re-evaluating inflation-related pricing strategies (55%) are very important to their ability to grow in 2022.

Globally, more than three leading optical fibre companies such as Corning, Fujikura, and Prysmian have clearly highlighted that inflationary pressures have significantly impacted their margins in the last two to three quarters.

With global cable manufacturers hitting on multiple fronts, they are now looking forward to a new pricing strategy to preserve margins. A pricing strategy that aligns well with the cost of goods and inventory management could possibly support them. Most industry leaders realize that they will need to find ways to inject agility and resilience into their organizations.

Global optical companies are increasing prices to offset inflationary pressures

Global financial analysts have broadly cheered vendors’ ability to get more money for their existing products, but incorporating or raising prices for existing contracts has been difficult. It is expected that these players will incorporate a new pricing strategy for the latest deals and products.

Some of the players who are making the first move in raising product prices, are Commscope, Nokia, and Corning:-

Commscope:

“We are making good progress in our efforts to raise prices in order to offset the profitability impacts of inflation,” CommScope CFO Kyle Lorentzen said in its Q3 FY 22 conference call.

Global financial analyst Raymond James said in its recent note to investors, “We consider this significant because CommScope has historically had a hard time increasing prices, particularly in its operator/service provider customer verticals.”

Nokia:

The big Nordic vendor of 5G equipment appears to be conducting similar price hikes. Nokia officials at the recent MWC trade show in Barcelona, Spain. “Its prior 2022 operating margin forecast of 11%-13.5% incorporates this pricing strategy, along with its assessment of input cost changes.”

Corning:

Corning recently quoted that the company’s recent price increases were a driving factor behind the 7% rise in the company’s fibre division income (FY 2021-2022). “Certainly better price realization helps on the revenue line,” said Corning CEO Wendell.

It is quite clear that there is definite upward pressure on prices, but unlike commodity and consumer goods prices, which have a very close correlation to inflation, infrastructure pricing is much more nuanced. Long-term supply contracts over multiple years make it difficult for global optical vendors to suddenly increase prices. Possibly, the industry-wide transition to software and virtualization could help lower pricing.

Focus on implementing new strategies

Though there is one right strategy in this industry to preserve margins during this stormy business environment, we can explore quite a few which can create long-term impact:

Mitigating supply chain risk

It is imperative to sidestep the supply chain difficulties and mitigate supply-chain risks. Prysmian has undertaken an approach to make the supply chain more resilient. Prysmian continuously assesses potential risks such as single sourcing, offer/demand unbalance, and financial risk. These risks are managed by long-term supply agreements when the supplier is unique or substitutable only with great difficulty and for a long time. In the event of financial risk or tight market offers, Prysmian cooperates with technical functions to identify alternative suppliers to ensure diversification of sourcing options.

Similarly, to create a diversified pool of suppliers, Corning has created a consortium called ‘Group Purchasing Organizations” (GPOs) in different markets to understand what they are doing and how they can benefit by connecting with different suppliers. This consortium approach not only offers cost benefits but opens up new market opportunities: – understanding best practices, market intelligence, and new product categories.

“You can do value engineering, optimize and manufacture products more effectively, but what we’ve found is the next threshold is really to work with other like-minded organizations and highlight the importance of supply chain collaboration and to leverage procurement consortiums where applicable.” -Tom Kruse, Global Head, Supply Chain Collaboration, Corning

Launching new business transformation programs

Restructuring the business and realigning the cost objectives is one of the few ways to manage inflation. Recently, Commscope presented its business transformation plan at an investor-meet Dec 2022. Through a business transformation plan, Commscope aims to increase its EBIDTA and easily manage the growing inflationary pressures. Some of the planned actionable steps are:- to divest non-core assets, optimize capital allocation, and target product introductions.

Paying strong attention to global developments and changing policies

In these changing times, optical companies need to pay attention to global developments, the realignment of countries’ alliances, and the changing policies of international suppliers. These factors can no longer be taken for granted. One of the industry players that has been able to foresee such global developments is Corning. Corning has smartly managed the chipset crisis by improvising its global supply chain and by creating a pool of diverse suppliers. In addition to this, Corning is one of the first industry players to mitigate inflation through increased prices. They took a significant number of price actions in the back half of 2021.

Conclusion

Well, it is undeniably true that supply chain problems and inflationary pressures exist and will continue to do so. It’s critical to gain a thorough understanding of these issues and formulate a strategy to deal with these rapidly evolving challenges.